- The Technical CEO

- Posts

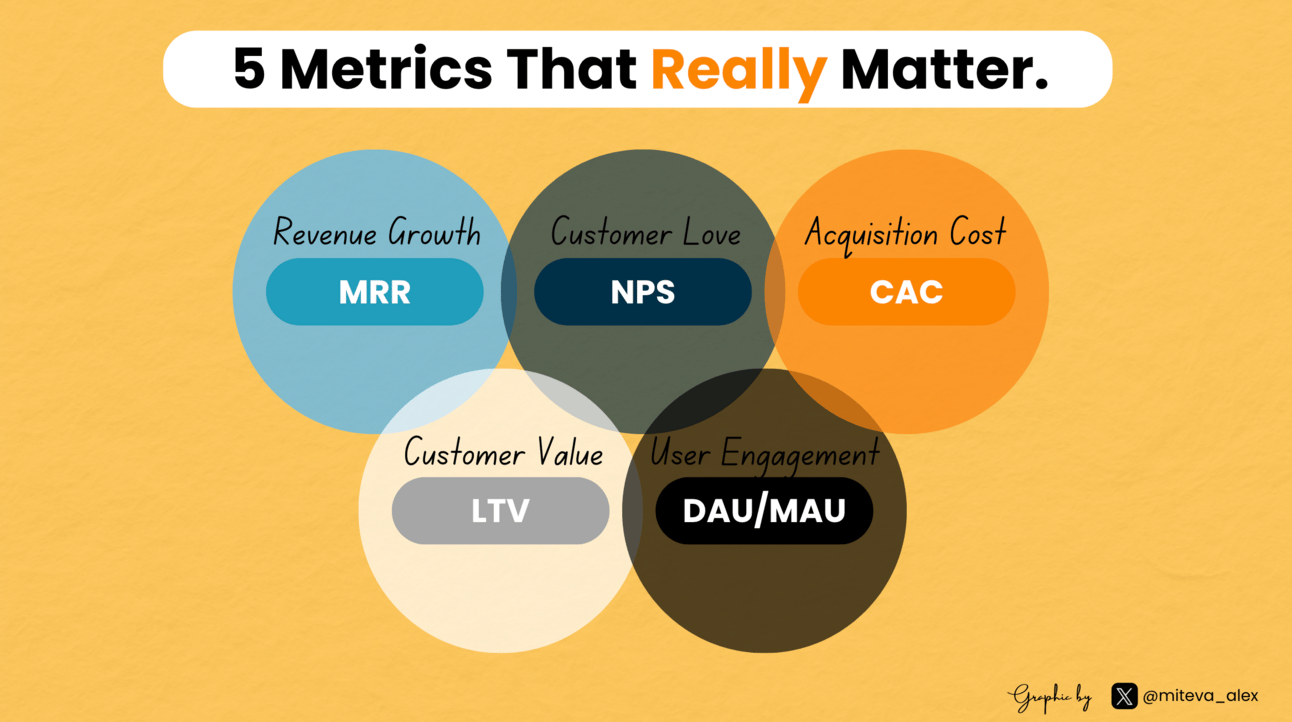

- 5 Underrated Metrics Every Founder Must Track.

5 Underrated Metrics Every Founder Must Track.

A Guide to Metrics That Actually Matter.

📚 Building a successful startup isn't about tracking everything—it's about focusing on the metrics that truly drive growth. Here are five numbers that can transform your startup from surviving to thriving✨.

Read Time ~ 2 min.

☕ 5 Startup Metrics That Actually Matter.

I'm not writing this as a founder, but as a developer who's made mistakes building more and focusing on customers less. Building is messy, and data can be overwhelming. Here are some metrics to help you keep your focus on the end goal, helping both the customer and yourself (you need to look out for both).

Net Promoter Score (NPS) 🌟

Your product isn't as amazing as you think until your customers say it is.

The Raw Truth: NPS ranges from -100 to +100. Netflix hits around 68, while most SaaS companies average 30.

Reality Check: While 50+ is the dream, start by celebrating small wins. A jump from 15 to 25 in three months? That's real progress.

Developer's Confession: A 10-point NPS increase typically correlates with a 20-30% reduction in customer acquisition costs. I've seen startups turn an NPS of -5 into +45 in a year just by acting on user feedback.

Customer Acquisition Cost (CAC) 💸

Time for some uncomfortable math: how much are you bleeding to gain each customer?

Behind the Numbers: Average B2B SaaS CAC ranges from $200-$300 for SMB customers to $7,000+ for enterprise. If you're spending over $500 to acquire a customer worth $400, you're in trouble.

Smart Play: I've seen startups cut CAC by 40% by switching from broad LinkedIn campaigns ($15-20 per click) to targeted developer communities ($5-7 per click).

Monthly Recurring Revenue (MRR) Growth 📈

The metric most startups misunderstand: sustainable growth beats viral spikes.

The Real Signal: Example: $10K MRR growing at 15% monthly becomes $45K in 12 months through compound growth.

Target Zone: A company starting at $5K MRR growing steadily at 12% monthly hits $20K MRR in a year – more sustainable than jumping from $5K to $50K and crashing back to $15K.

Brutal Reality: I've watched startups chase 50% monthly growth, burn out, then settle for -5% growth. Steady 15% wins.

Daily Active Users / Monthly Active Users (DAU/MAU)

This ratio exposes whether your product is a vitamin or a painkiller.

Truth Detector: Slack's DAU/MAU ratio is around 65% - people need it daily. Social apps often sit at 10-15%.

Victory Threshold: At 20%, you're building a habit. At 50%, you're becoming essential. Below 10%? You're optional.

Wake-Up Call: A drop from 25% to 15% DAU/MAU often precedes churn spikes of 20-30%. Watch this number religiously.

Customer Lifetime Value (LTV) 💎

The metric that exposed my biggest developer mindset mistake: thinking launch day was the finish line.

Golden Insight: If your average customer pays $50/month and stays for 24 months, that's a $1,200 LTV. Now you know you can spend up to $400 on acquisition (LTV:CAC ratio of 3:1).

Power Move: A 5% increase in retention can increase LTV by 25-95%. Example: Keeping a $100/month customer for 20 months instead of 18 months adds $200 to LTV.

The Hard Truth: Companies with 3x higher LTV than competitors typically have 60% lower churn rates. It's not about getting customers - it's about keeping them.

Bottom Line: Most founders chase metrics that look good in pitch decks. The winners? They obsess over metrics that reveal real value. These five numbers aren't magic – they're your North Star in the startup chaos.

Keep building, stay focused, and remember: what you measure becomes what you improve.